Tax Class

About this article

In this article you will learn how to create, rename and remove a Tax Class. Once you have created a Tax Class you can use it as a mechanism to control which ‘Tax Rules’ get applied to Orders. Tax Classes can be set on Wholesale Accounts and Retail Customers. If a Tax Class is set for an Account or Customer, all Orders placed for that Account or Customer will automatically be marked with the same Tax Class. You can use Tax Classes to ensure you charge each Account and Customer the correct taxes as required by applicable legislation. Typical usage of Tax Classes include ensuring Accounts or Customers that are exempt from certain sales taxes or VAT are not charged with these taxes.

Besides Tax Classes, Centra also has the concept of ‘Tax Groups’, for controlling which Tax Rules are applied to different types of goods and how taxes are shown and charged in each Store

You must be a Full Access Administrator to setup a tax rule or have relevant access rights, if that is not you, please ask internally before contacting Centra Support.

Creating a Tax Class

- Go to 'System' > 'Tax Classes' in the main menu to the left

- Click '+Tax Class' in to upper-right corner

- Name your Tax Class

The Name of the Tax Class needs to be unique, cannot be blank, and must be maximum 30 characters long

We recommend using a short descriptive name for the Tax Class, for example “NY Sales Tax Exempt’, for a Tax Class to be used for Accounts that are exempt from paying sales tax in the state of New York

- Click 'Save' and the new Tax Class will appear in the list of Tax Classes.

There is one default Tax Class in Centra called “VAT Exempt”. It is possible to rename it, but it is not possible to remove it. Centra can automatically assign this Tax Class to orders for which a valid European Union VAT number is provided, after verifying the number is correct

You have now created a Tax Class that is ready to use in Tax Rules

Removing a Tax Class

If a Tax Class is no longer needed, it can be removed.

- Go to 'System' > 'Tax Classes' in the main menu to the left

- In the list of Tax Classes, click the Tax Class you would like to remove

- Click 'Delete' and confirm deletion when asked to confirm.

When deleting a Tax Class, it will automatically be removed from all Accounts, Customers and Tax Rules, but it will not be removed from any Orders already made and already applied taxes will not be changed

You have now removed the Tax Class

Renaming a Tax Class

A Tax Class can be easily renamed.

-

Go to 'System' > 'Tax Classes' in the main menu to the left

-

In the list of Tax Classes, click the Tax Class you would like to rename

-

Click 'Edit'

-

Type a new name in the 'Name' field

The Name of the Tax Class needs to be unique, cannot be blank, and must be maximum 30 characters long

-

Click 'Save'.

Centra will automatically update the name of the Tax Class on all Accounts and Customers and in all Tax Rules

You have now renamed the Tax Class

Using a Tax Class

A Tax Class has no effect until it is added to minimum one Tax Rule, added to at least one Account/Customer and an Order is placed with that Tax Class.

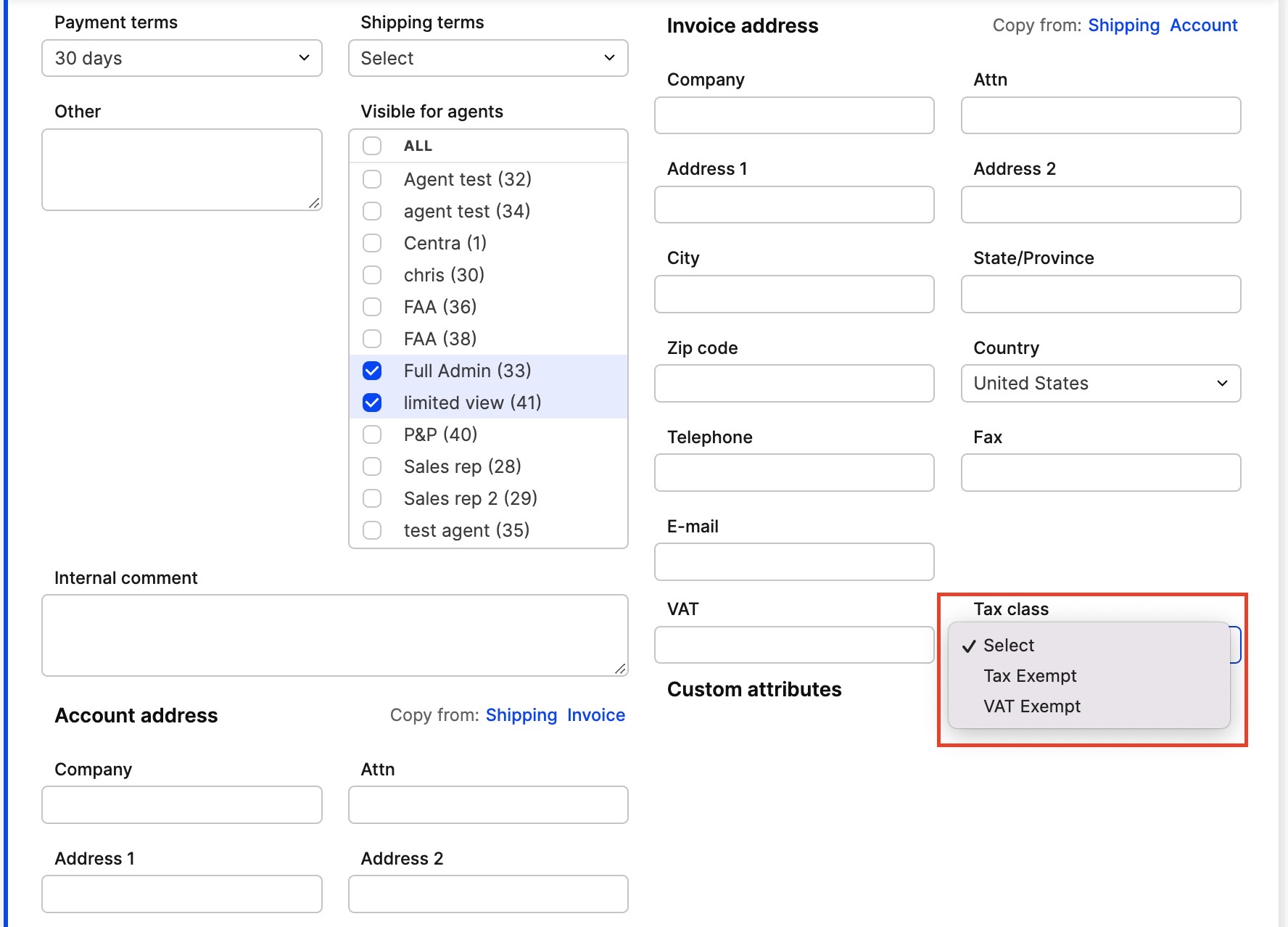

Adding a Tax Class to an Account

- Under WHOLESALE in the main menu to the left, go to 'Accounts'

- Open the account in the list that you would like to add a Tax Class to, by clicking on it

- In the Invoice address section, choose the appropriate Tax Class

- Orders placed for this Account will now receive the Tax Class you selected

In case of VAT Exemption in the European Union you should choose Tax Class and insert a valid VAT number in order to add tax exemption status

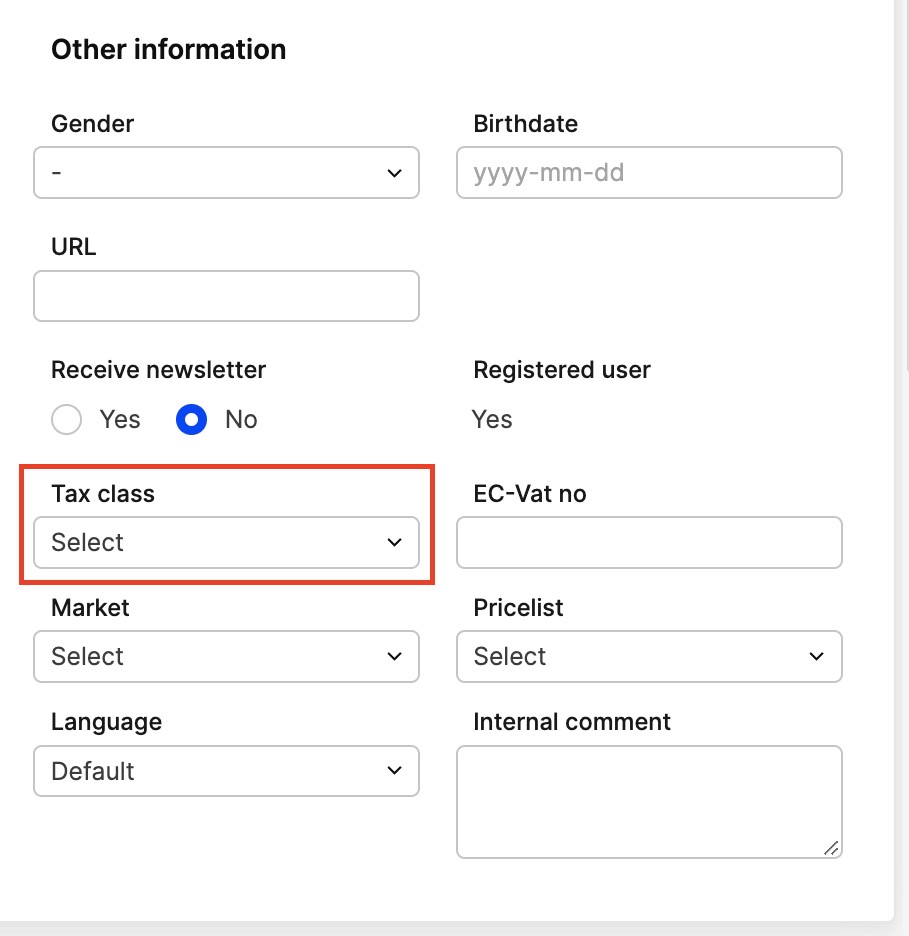

Adding a Tax Class to a Customer

A Tax Class can be added to a Customer when creating a new Customer from the Centra backend or when you want to modify an existing Customer.

- Under DIRECT TO CONSUMER in the main menu to the left, go to Customers

- In the Other information section, choose the appropriate Tax Class

- Orders placed for this Customer will now receive the Tax Class you selected.